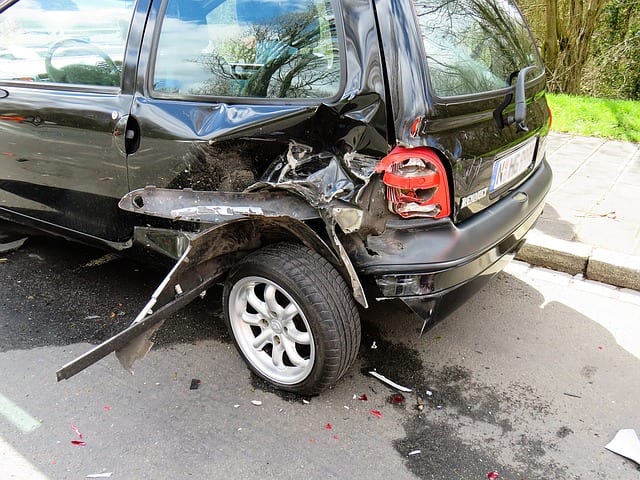

Accidents can be a stressful experience. Not only do you have to deal with the physical and emotional aftermath, but it can also affect your car insurance for years to come. That is why you need a Tucson Car Accident Attorney they are experienced in this field of law. This blog post will discuss how accidents affect car insurance.

How Long do Your Insurance Rates Will be Affected?

Well, it depends. If the collision was not your fault and did not involve injury, then you shouldn’t see any change to your premiums. However, if you were at fault or caused an injury-related accident for which someone sought medical care, then expect to pay more for coverage over the next few years.

Well, it depends. If the collision was not your fault and did not involve injury, then you shouldn’t see any change to your premiums. However, if you were at fault or caused an injury-related accident for which someone sought medical care, then expect to pay more for coverage over the next few years.

How Long do Car Insurance Rates go Up After an Accident?

After a car accident, your premium will likely increase for three years. However, certain factors could make the impact longer or shorter. If you have filed any other claims in the past few years, then it is more likely that your rate will be affected by the latest accident. Suppose you were cited for careless driving or other negligent behavior.

In that case, your rates will likely increase by about 25%, the same amount that the rate would go up if there were a minor injury in an accident where you were not at fault. While every insurance company is different and car accidents are certainly stressful experiences, knowing how long they can affect your premiums can greatly relieve you.

Ways to Lower Your Rates After an Accident?

If you’re unfortunate enough to have an accident, then your rates must go down again within a few years. If not, don’t worry. You can always look for discounts with current providers and ensure every penny counts to get all the benefits available.

If you’re unfortunate enough to have an accident, then your rates must go down again within a few years. If not, don’t worry. You can always look for discounts with current providers and ensure every penny counts to get all the benefits available.

Common car insurance savings include paying full premium upfront or being associated with groups/associations that offer incentives like military service members do when they qualify. Some also allow switching from paper billing systems if possible You might also get student rates if you maintain good grades and bundle home coverage with auto for the best price possible.

Car Accidents Can Affect Getting New Insurance

Shopping for car insurance is a tricky business. You want to find the best rates possible. Still, some companies offer fewer coverage options than others and might not be as good when you get into an accident which can weigh your rate higher with one company vs. another even if both are considered “dangerous” drivers on record.

Businesses often have different rules about what they penalize or reward customers who make accidents in their records. Though this isn’t always true, comparing prices may give better results overall because each insurer will assess damages differently according to factors like the age and gender of the driver at fault as well as other factors.

Car insurance rates will go up for 3 years after an accident, and there are ways to lower them again with:

- Discounts

- Bundling services

- Safe-driving deals

You can also find better deals depending on the company’s policies towards certain types of accidents.